The E-Way Bill system revolutionizes logistics by providing a streamlined, digital method for tracking the movement of goods across states. This topic explores the essential process and criteria for generating an E-Way Bill including regulatory compliance, necessary documentation, and the benefits of leveraging technology to enhance efficiency and transparency in the supply chain.

What is E-Way Bill?

An E-Way Bill is an electronic document generated on the GST portal that is required for the transportation of goods in India. It serves as a permit for the movements of goods in GST regime. The E-Way Bill contains details about the goods been transported i.e., the consignor, consignee, and the transporter. It is to be carried by a person in charge of conveyance of goods with value exceeding Fifty Thousand rupees as a mandate by the Government in terms of Section 60 of GST Act.

1. Compliance with GST Regulations : The E-Way Bill system is a compliance mechanism introduced under the GST Regime to ensure goods being transported comply with tax regulations. It helps authorities track the movement of goods and prevent tax evasion.

2. Seamless Movement of Goods : It facilities the smooth movement of goods across states and reduces the need for physical checkpoints, which often cause delays in the transportation process.

3. Transparency and Accountability : The E-Way Bill system increases transparency in the transportation of goods by providing a digital record of goods being moved, which can be verified by tax authorities.

4. Standardization : It standardizes the process of documenting the movement of goods, making it easier for businesses to follow the requirements and for authorities to monitor the transport of goods.

5. Reduction in Tax Evasion : The E-Way Bill system helps curb tax evasion by making it difficult for goods to be moved without proper documentation. This ensures that all goods being transported are accounted for and taxed appropriately.

6. Integration with GST Network : The E-Way Bill system is integrated with the GST network, providing real time data to tax authorities about the movement of goods. This integration helps in better compliance monitoring and reduces the chances of discrepancies.

Readiness for the E-Way Bill Generation

To generate an E-Way Bill certain pre-requisites must be fulfilled to ensure compliance with the GST Regulations -

1. Access the Portal : Log in to the E-Way Bill portal using the GSTIN and password.

2. Select ‘Generate New : After logging in navigate to E-Way option to the menu and click on generate.

3. Enter Details : Fill in the required details in Part A of the form, including the GSTIN of the supplier and recipient, the invoice or challan number and the value of goods, documents details, goods description, place of dispatch and delivery.

4. Transportation details : Fill in Part B with details about the mode of transportation, vehicle number, or transporter ID.

5. Submit the Form : Review the entered details to ensure accuracy, click ‘Submit’ to generate the E-Way Bill.

6. Obtain the E-Way Bill Number : Once submitted, the system will generate a unique E-Way Bill Number. It can be printed or saved for reference.

a. Part A -

- GSTIN of supplier and recipient

- Place of dispatch and delivery

- Document number and date (Invoice, bill, or challan)

- Value of goods

- HSN Code

- Reason for transportation

b. Part B -

- Vehicle number, if transported by road

- Transport document number

- Transporter ID, if using a transporter to supply goods

The ability to access the internet and use the E-Way Bill portal, as the process is conducted online.

7. Mode of Transportation :Details about the mode of transportation must be provided, along with the vehicle number or transporter details.

By ensuring these pre-requisites are met, businesses can generate E-Way Bills efficiently and comply with the GST requirements for transporting goods within and across state boundaries.

Who can generate the E-Way Bill?

The E-Way Bill can be generated by the following parties-

1. Registered Suppliers : Suppliers of goods registered under GST can generate an E-Way Bill for the transportation of goods they are dispatching.

2. Registered Recipients : In the case where the recipient is responsible for the transportation, they can generate the E-Way Bill.

3. Transporters : If the supplier or recipient has not generated an E-Way Bill, the transporter can generate one using the transporter ID. This is particularly useful for logistics companies managing the transportation of goods.

4. Unregistered Persons : An unregistered person transporting goods can generate an E-Way Bill through the E-Way Bill portal by selecting citizens and providing their details.

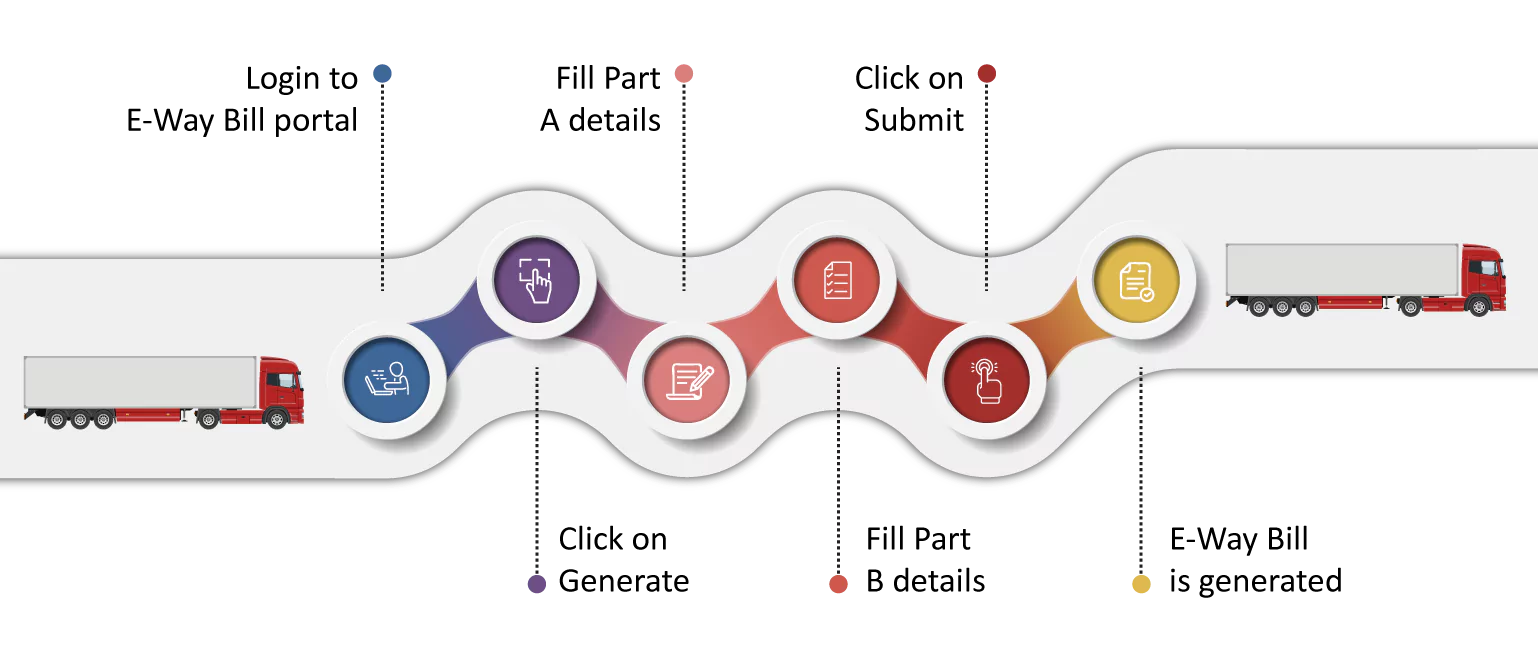

Process of E-Way Bill Generation

1. Access the Portal : Log in to the E-Way Bill portal using the GSTIN and password.

2. Select ‘Generate New : After logging in navigate to E-Way option to the menu and click on generate.

3. Enter Details : Fill in the required details in Part A of the form, including the GSTIN of the supplier and recipient, the invoice or challan number and the value of goods, documents details, goods description, place of dispatch and delivery.

4. Transportation details : Fill in Part B with details about the mode of transportation, vehicle number, or transporter ID.

5. Submit the Form : Review the entered details to ensure accuracy, click ‘Submit’ to generate the E-Way Bill.

6. Obtain the E-Way Bill Number : Once submitted, the system will generate a unique E-Way Bill Number. It can be printed or saved for reference.

Revolutionize your E-Way Bill process

Navigating the E-Way Bill process can be challenging for multiple businesses. While the government portal provides a basic framework, it often falls short in terms of user experience and advanced functionality. TCS iON E-Way Bill Solution offers a seamless and efficient alternative to meet the needs of modern businesses. With the features listed below, it offers a comprehensive and user-friendly experience.

1. Simple to use :

- Automate E-Way Bill generation effortlessly with E-Invoicing or schedule it as needed.

- Auto-calculate distances in E-Way Bills for accurate information.

- Generate E-Way Bills seamlessly after cancellation without the need to re-upload files.

2.Bulk processing capability :

- Upload bulk files either in Excel, CSV, or JSON in the system to generate E-Way Bill.

- Download multiple bills' PDFs with just one click.

3.Easy to view data:

- Utilize the variety of filters to view and filter data for different functionalities.

- Sort and view data based on specific business branches and verticals to meet your unique needs.

4.Auto-calculation of distance :

- Ensure E-Way Bill validity with automated distance calculation.

- Simply input the PIN numbers for the source and destination to streamline the process.

5.Integrate your existing E-Way Bill data seamlessly :

- Exchange data in any of the following three ways from your billing system or ERP to our E-Way Bill software.

- Manual upload.

- SFTP (Secure File Transfer Protocol) based data exchange.

- API-based data exchange.

6.Single login for Multiple GSTINs :

- Manage multiple reporting entities with just one login, allowing you to seamlessly work with different GSTINs.

7.Dashboards & Reports :

- Evaluate the organization’s performance and enhance the decision-making process with multiple analytical dashboards, business intelligence and reports generated by the solution.

8.Automated E-Way Bill messages :

- Send E-Way Bill PDFs automatically to goods recipients and transporters via email for seamless collaboration.

Overall, the E-Way Bill system plays a crucial role in the GST Framework by enhancing tax compliance and facilitating the efficient movement of goods in India. Embrace a more efficient and effective approach in managing E-Way Bills with TCS iON E-Way Bill Solution. By understanding the process and utilizing the appropriate tools, businesses can streamline their logistics, enhance efficiency, and maintain compliance with regulatory requirements.

To learn more and be a part of our growing community , Register on TCS iON BizHub today .