Know more about the transformative journey of Indian Chemical manufacturers and small Pharmaceutical companies, driven by domestic demand, sustainability, and digitalization. Explores market trends, growth opportunities, and the sector's pivotal role in employment, GDP, rural development, and global leadership, sum up India's rapidly growing potential.

The Indian Chemical and Pharmaceutical (C&P) sector, situated within the tier-II and tier-III cities of 'Growing Bharat,' is on the verge of significant change. This change goes beyond just growing, it's an extreme transformation fueled by technological advancements, demographic trends, and rapidly expanding local markets. But how are these enterprises navigating challenges and emerging in this evolving landscape? What does the future hold for SMEs in India's chemical and pharmaceutical industries?

As sustainability takes center stage and digitalization reshapes traditional business models, chemical and pharma SMEs are carving out ideal positions, boosting innovation, and expanding their global footprint. This blog discusses the transformation, challenges, and opportunities for SMEs in India's Chemical and Pharmaceutical sector.

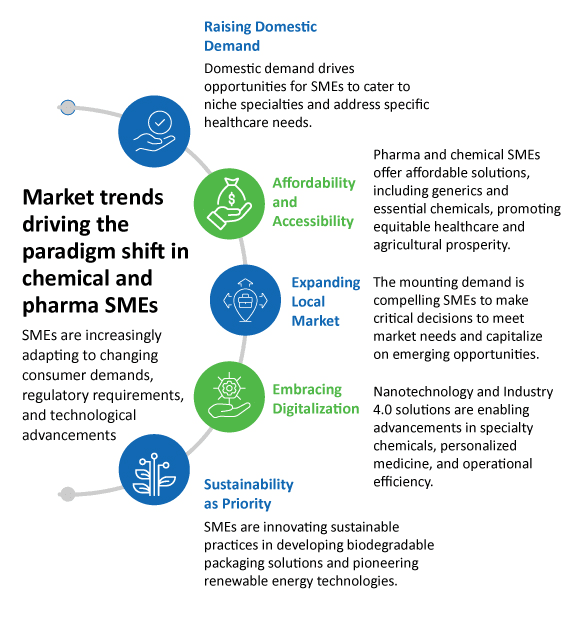

Market trends driving the changes in small pharma companies and chemical manufacturers

Market trends steer SMEs to adapt to changing consumer demands, regulatory requirements, and technological advancements. Here are a few market trends motivating SMEs to redefine their strategies.

Rising domestic demand

India is set to substantially contribute over 20% of the global chemical consumption growth in the next two decades, with domestic demand expected to reach $1,000 billion by 2040, according to a McKinsey report. The pharmaceutical sector, anticipated to grow by 9-11% this fiscal year, is primarily driven by domestic demand. Domestic demand can be profitable as it faces less competition from expensive branded drugs. The evolving domestic demand within the chemical industry is shifting its focus towards niche specialty chemicals like agrochemicals, construction chemicals, textile chemicals, and personal care products, offering SMEs opportunities to cater to specific industries.

The government emphasizes domestic pharmaceutical production to enhance supply security and reduce reliance on imports, potentially offering financial incentives and streamlined regulations for SMEs. They can capitalize on specific needs within the domestic pharmaceutical market, such as

- Developing drugs for neglected diseases.

- Herbal and traditional medicine.

- Focusing on specific demographics.

- Drug access in underserved areas.

- Personalized medicine.

- Delivery systems and adherence.

- Addressing Antimicrobial Resistance (AMR).

With these opportunities, SMEs are positioned to play an important role in meeting the increasing demands, innovation, expansion, and market penetration.

Focus on affordability and accessibility

India has emerged as a global leader pursuing equitable healthcare, particularly in providing affordable and accessible medicines. As per Invest India , India holds a substantial share of approximately 20% in the global supply of generic medicines, solidifying its position as the leading provider worldwide and in its own country.

SME pharma companies excel at developing and manufacturing generic versions of patented drugs. With their agility and ability to cater to niche markets, SME pharma companies are focusing on R&D for neglected tropical diseases (NTDs), ensuring the development of affordable treatments for developing countries like India. Also, domestic manufacturing of Active Pharmaceutical Ingredients (APIs) (active ingredients in medicine) and finished dosage forms (final drug product) are reducing dependence on imports and potential price fluctuations.

SME chemical companies in India are instrumental in making essential chemicals more available. These companies use locally available raw materials, thereby reducing dependence on expensive imported materials, optimizing production costs, and making the final chemical products more affordable.

Indian farmers in rural and semi-urban areas are thus able to use low-cost generic versions of essential chemicals like fertilizers and pesticides. Additionally, they're exploring bio-based alternatives derived from renewable resources, which are environmentally friendly and cost-effective for farmers.

Rapidly expanding local markets

The rapid expansion of local markets in India has encouraged heightened demand for pharmaceuticals, agrochemicals, and specialty chemicals, driven by increased access to healthcare and consumer goods.

This demand has increased the focus on innovation within these industries that requires developing new formulations, enhancing drug delivery systems, and tailoring chemical products to local needs. As consumers become more knowledgeable about product quality and safety, Indian SMEs prioritize stringent quality control measures to build trust both locally and globally.

Pharmaceutical SMEs cater to local health needs by offering generic drugs, over-the-counter medications, and specialized formulations. They invest in research to develop new drug formulations and enhance therapeutic efficacy. (wanted effects with regard to the aim of therapy) The rising preference for natural alternatives has boosted the popularity of Ayurvedic and herbal products, driving India's export market.

Did you know?

India is the second largest exporter of herbal and Ayurveda products, with exports totaling $628.25 Mn as of 2023.

Domestic players compete eagerly with multinationals through partnerships, acquisitions, and accessing new markets and tech in a dynamic landscape. Local market growth lets Indian firms expand internationally, using domestic strength and cost advantages for global exports.

Sustainability and environmental concerns

According to projections by CSE, India aims to decrease carbon emissions by 1 billion tonnes by 2030 to achieve a challenging target of reducing emissions by 22%. The demand for sustainable packaging materials drives chemical enterprises to innovate with biodegradable polymers, bio-based plastics, and recyclable packaging solutions. The India Packaging Market, projected to reach USD 204.81 billion by 2025, is growing rapidly at a CAGR of 26.7%. With processing and packaging costs up to 40% lower than in parts of Europe, Indian chemical and pharma SMEs present an attractive investment destination.

Chemical SMEs also lead advancements in photovoltaic technologies, (convert sunlight directly into electricity) focusing on large-scale, cost-effective synthesis methods for perovskite(a natural mineral consisting of oxides of calcium and titanium) materials in solar cell production.

In the pharmaceutical industry, SMEs are at the forefront of environmental initiatives, championing green chemistry practices, eco-friendly production methods, and biocatalysis (use of natural substances that include enzymes from biological sources or whole cells to speed up chemical reactions) to minimize waste, reduce dependency on harsh chemicals, and pioneer sustainable drug delivery systems.

Technological advancements

Technological advancements in nanotechnology and materials science foster innovation in specialty chemicals and drive progress in nanomedicine. Through controlled release technologies and Industry 4.0 solutions like smart manufacturing and automation, pharma SMEs optimize production, reduce costs, and improve efficiency. Advancements in genomics (focused on studying all DNA of organisms), molecular diagnostics, and digital health technologies are driving the development of personalized medicine approaches.

In 2024, the Department of Pharmaceuticals released the Revamped Pharmaceuticals Technology Upgradation Assistance Scheme for micro, small, and medium enterprises (MSMEs). The scheme emphasizes upgrading technological capabilities to align with WHO-GMP (Good manufacturing practices) standards indicating that technology enhances the quality and safety of pharmaceutical products manufactured in India.

Chemical SMEs, on the other hand, are using data analytics and machine learning to optimize their processes, minimize waste, and enhance efficiency.

Growth opportunities for chemical manufacturers and small pharma companies in India

The Indian chemical manufacturers and small pharma industry offers many exciting opportunities for SMEs to cater to the domestic market and emerge as global players. Let's explore some of these high-growth segments

Chemical industry :

Inorganic chemicals : According to the India Brand Equity foundation, the accessibility of raw materials heavily influences the production of inorganic chemicals. Despite this, a robust demand for various inorganic compounds exists, making it an attractive market for SMEs.

Focusing on exports in the inorganic sector can be particularly lucrative for SMEs, with products such as carbon black, sodium, and titanium poised to drive growth. Two notable opportunities for SMEs lie in:

1. Fluorine :Predicted to reach a market value of US$ 4.2 billion by 2040, with a CAGR exceeding 10%. This growth is expected to be fueled by increased demand from key end-use industries such as pharmaceuticals and agricultural chemicals.

2. Sodium and caustic : The subsegment of sodium and caustic is projected to see a CAGR close to 10%. By 2040, the market potential for sodium and caustic could reach US$13 billion and US$11.5 billion, respectively.

Rise of battery chemicals : Programs like the Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme, the National Electric Mobility Mission Plan (NEMMP), and the Phased Manufacturing Program (PMP) offer incentives, subsidies, and tax advantages to manufacturers. These policy initiatives have spurred investments and facilitated the expansion of EV battery manufacturing within India. SMEs can specialize in specific battery chemicals needed for EV battery production, like lithium-ion components (cathode materials, anode materials, electrolytes). SMEs can also position themselves as reliable Tier 2 or 3 suppliers, providing essential battery chemicals to larger companies. Through developing a self-sufficient supply chain, India seeks to diminish its reliance on imports, improve cost competitiveness, and fortify the EV battery manufacturing ecosystem.

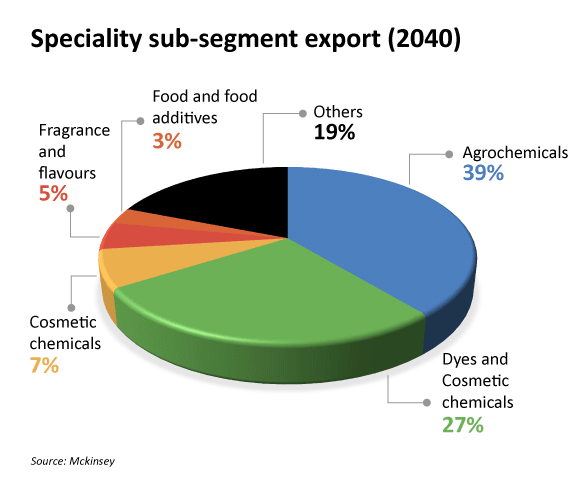

Specialty chemicals : Specialty chemicals are a cornerstone of India's chemical industry, boasting a net trade surplus and poised for remarkable growth. Projections indicate a tenfold increase in net exports by 2040, soaring from approximately US$2 billion in 2021 to a robust US$21 billion. The Specialty Chemicals segment is driving this expansion and is expected to lead the charge in India's chemical export landscape.

Four key sub-sectors are set to spearhead nearly 80% of exports within this segment. These sub-sectors exhibit exceptional potential, with the capacity to amplify their current contributions multifold.

Agrochemicals valued at US$ 5.5 billion demonstrate an impressive 8.3% Compound Annual Growth Rate (CAGR). Projections envision their dominance, capturing 40% of India's chemical exports by 2040 and claiming nearly 13% of the global agrochemical industry.

The Food and Feed Ingredient Chemicals market, encompassing nutraceuticals, food and feed additives, flavors, and fragrances, is worth US$3 billion in India. With a steady growth trajectory of 7-9% CAGR, this sub-segment holds promising expansion and market penetration prospects.

Fluoropolymers emerging as a niche space : Fluoropolymers are gaining traction, especially as Japan and Korea look to India as a supply partner amidst trade and geopolitical issues with China. The India Fluorochemicals Market, valued at approximately USD 622 million in 2022, is projected to witness a compound annual growth rate (CAGR) of around 10.24% during the forecast period from 2024 to 2029.

Fluoropolymers are in high demand in India's electrical and electronic industry due to their chemical resistance, thermal stability, low friction properties, and flame resistance. They find applications in the automotive, aerospace, packaging, electronics, solar, and construction industries.

Pharmaceutical industry:

The Indian Ministry's initiative, known as the "Strengthening of Pharmaceutical Industry (SPI)" scheme, allocates a total financial outlay of US$ 60.9 million (Rs. 500 crore) to provide essential support to existing pharmaceutical clusters and MSMEs nationwide. This support aims to enhance productivity, quality, and sustainability within the industry.

Nutraceuticals : Witnessing a surge in health consciousness, the Indian nutraceutical market is estimated to reach USD 18 billion by the end of 2025. This presents a golden opportunity for SMEs to develop and manufacture innovative nutraceutical and cosmeceutical products catering to this growing demand.

API (Active Pharmaceutical Ingredient) Manufacturing : India is the third largest producer of APIs, accounting for an 8 percent share of the Global API Industry. 500+ APIs are manufactured in India, contributing 57 percent to the WHO's prequalified list. This presents a lucrative opportunity for SMEs to specialize in specific therapeutic segments or develop niche APIs with high growth potential.

Biologics and Biosimilars : India is positioned as the emerging center for biologics and biosimilars, with an anticipated Compound Annual Growth Rate (CAGR) of 22% shortly. Biosimilars are more affordable versions of existing biology and are gaining traction. This shift necessitates expertise in biotechnology for pharma companies and a focus on producing the chemical industry's necessary biomaterials and fermentation processes.

Impact of chemical and pharma SMEs on growing bharat

Chemical and Pharma SMEs are like the engines powering Bharat's progress, playing a crucial role in how fast it's growing. Let's take a closer look at how these SMEs are shaping India's future.

Employment generation

- Production-Linked Incentive schemes are expected to boost high-value product production, increase export value addition, and create employment opportunities, including 20,000 direct and 80,000 indirect jobs.

- Likewise, India's chemical industry spans 80,000 products, employs over two million people, and accounts for 3.4% of the global market.

Contribution to GDP

- Spread throughout India with 63.4 million units, the MSME sector accounts for approximately 6.11% of the manufacturing GDP and 24.63% of the GDP derived from service activities.

- As per the Press Information Bureau of India, the pharmaceutical industry has the potential to expand to USD 120-130 billion (₹ 9,84,000 to ₹ 10,66,000 crores) in the coming decade. This growth could elevate its contribution to the GDP by approximately 100 basis points.

- According to analysts at S&P Global Commodity Insights, the Indian market for chemical commodity products is forecasted to grow by approximately 7% in 2023 and 8% in 2024. This growth outpaces the anticipated annual economic growth rate of 6%-7.1% for the fiscal years 2024-2026.

Rural development

- According to Forbes, SMEs constitute 96% of industrial units in India and are pivotal for rural development. They contribute 40% to industrial production and 42% to exports and have created 7.56 lakh jobs in the past six years, thus significantly alleviating unemployment issues.

- Pharmacies and SME chemical industries in rural areas contribute significantly to development by providing essential medications, health education, tele pharmacy services, community health initiatives, local employment, value addition to resources, support for agriculture, technology innovation, skill development, environmental sustainability efforts, and engagement in community initiatives.

Making India a global leader

- India is the world's largest vaccine producer and the sixth-largest chemical producer globally, so it is poised for further achievements. India holds significant potential to address domestic healthcare needs and contribute substantially to global health initiatives.

- Globally, India holds a leading position as the largest vaccine producer and also the second-largest exporter of herbal and Ayurveda products.

- By investing in research and development, collaborations with international partners, and promoting sustainable practices, India can emerge as a hub for cutting-edge chemical technologies.

Chemical and Pharma SMEs are one of the frontrunners and the driving force behind innovation in Growing Bharat. Their agility, deep market understanding, and R&D focus on the domestic middle class present a unique advantage at a global level. While technological advancements like AI-powered drug discovery and sustainable chemistry offer exciting opportunities, navigating the regulatory landscape remains a challenge. Also, better collaboration between industry, research, and government is essential to create an ecosystem that empowers these SMEs to thrive and redefine India's role in the global chemical and pharmaceutical landscape.

These enterprises aren't just businesses; they are catalysts for growth. By investing in their success, we're investing in India's future dominance on the global stage. Together, we can tap the full potential of India's SMEs and pave the way for a prosperous tomorrow.

TCS iON brings us easy-to-use multi-functional ERP system for manufacturing. This solution is tailored to suit the needs of the verticals like auto dealers, casting, chemical, compliance, FMCG, forging, oil, plastic, sheet metal, pharma. Visit TCS iON ERP Software for Manufacturing to know more.

To learn more and be a part of our growing community, Register on TCS iON BizHub today.