GST transforms India’s Tax System by simplifying compliance, ensuring transparency, and promote economic growth through a single tax scheme. Understanding its existence, types, return filing and staying updated with alerts are essential for businesses to know the GST System easily.

Decoding GST: Everything you need to know

The Goods and Service Tax or GST is a type of indirect tax, which is applicable to the supply of goods and services. An indirect tax is a tax charged or levied on goods and services consumed by individuals and businesses, and not directly levied on anyone’s income.

For example, Company A buys raw material X, which it processes into Product Y and sells to a wholesaler, Company B. Then, Company B sells Product Y to a retailer, Company C, who then sells it to individual customers. GST would be applicable at every point of sale in this process.

Under the earlier indirect tax regime, both the Indian Government and the State Governments charged multiple taxes at different rates. Moreover, the tax filing process was complex, and the system had many errors. This resulted in numerous challenges to taxpayers.

As part of a major reform in indirect taxation, GST came into effect from July 2017, replacing several taxes and levies such as excise duty, sales tax, service tax and VAT. GST was introduced with the purpose of bringing in a comprehensive and consolidated digital indirect tax system, which would be easier to apply, regulate, and comply with.

Reason for implementing GST

The key purpose of implementing the Goods and Services Tax was to simplify the tax structure and create a uniform and integrated tax system to reduce the tax burden on businesses and consumers.

Here are some of the key changes which GST has brought to the old taxes system:

- Preventing multiple tax effect i.e. tax on tax

- Removing the differentiation between goods and service

- Single window clearance – All in one go

- Freedom from multiple taxations

- Increased transparency

GST applies to all ‘businesses’

‘Businesses’ includes trade, commerce, manufacture, profession, or any other similar activity, irrespective of its volume or frequency.

This also includes supply of goods/services while starting or closing a business.

GST applies to all ‘persons’

‘Person’ includes individuals, HUF, company, firm, LLP, AOP, co -operative society, society, trust, etc. There are certain exceptions to this rule.

Goods and services like agricultural services, petroleum products, electricity, etc. are excluded from GST.

Types of GST

GST is a consumption-based tax levied at the time of sale/transfer. It is a destination-based tax. Simply put, GST is levied in the state where goods/services are consumed and not in the state where goods/services are manufactured/dispatched from.

- A dual GST model is followed in India with both Central and State Governments levying GST. GST levied on inter-state supply of goods or services is known as Integrated Goods and Service Tax (IGST).

- GST levied on intra-state supply of goods or services are of two types - Central Goods and Service Tax (CGST) collected by the Central Government and State Goods and Service Tax (SGST) collected by the State Government where the goods or services are consumed.

GST is levied on the value added to a product or a service. Tax on tax is avoided by allowing the supplier to take credit for any GST paid on goods or services used in production/delivery.

For example, Company A buys Raw Material X to manufacture Product Y and pays ₹100 as GST while purchasing X. This ‘input tax’ can be taken as credit and adjusted against GST payable on the value of Product Y sold. GST has four main tax rates: 5%, 12%, 18% and 28% as defined by the Government through the GST Council.

GST has replaced various indirect taxes that businesses were required to comply with, thereby reducing the burden of accounting and compliance. By consolidating tax rates, the tax levied on several goods has been brought down, reducing the impact of tax on some businesses.

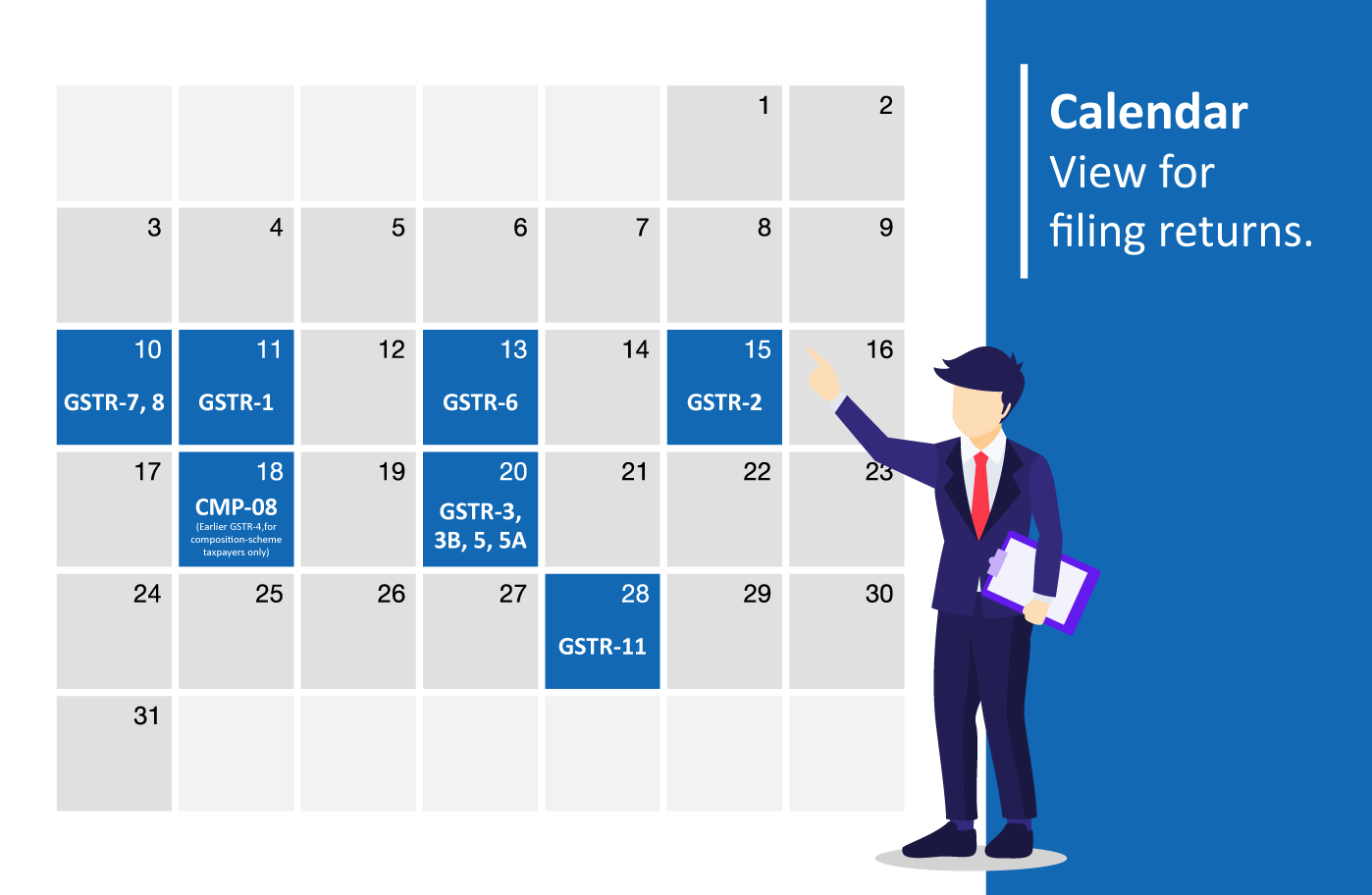

Types of GST returns : Why, when & how often should you file

Businesses registered under GST are required to prepare and file returns on a periodic basis to declare the taxable value of goods supplied. The following table will help you understand the various types of GST returns (GSTR) and what needs to be reported in these returns. This table will also help you determine which GST returns are applicable to your business.

Detailed view of types of GST returns

The below table explains in detail about types of GST returns, purpose of each of it and when to file :

| Type | Purpose | Frequency and Due Date |

|---|---|---|

| GSTR –1 | To be filed by all the normal taxpayers stating their outward supplies of goods and services during the applicable tax period. | Turnover < Rs. 1.5 crore – Quarterly, 31st of the month succeeding the quarter Turnover > Rs. 1.5 crore – Monthly, 11th of the succeeding month |

| GSTR-2 | Details of inward supplies of goods and services including those under reverse charge basis | Monthly, 15th of the succeeding month |

| GSTR-3 | All details of the outward and inward supplies, as mentioned in Forms GSTR-1 & GSTR-2 | Monthly, 20th of the succeeding month |

| GSTR-3B | To be filed by all the normal taxpayers declaring their summary GST liabilities for the applicable tax period | Monthly, 20th of the succeeding month |

| CMP-08 (Earlier GSTR-4, for composition-scheme taxpayers only) | To declare summary of outward supplies and import of services liable to reverse charge mechanism | Quarterly, 18th of the month succeeding the quarter |

| GSTR-5 (for non-resident taxpayers) | To be filed by non-resident taxpayers when they do not wish to claim Input Tax Credit (ITC) | Monthly, 20th of the succeeding month |

| GSTR-5A | To be filed by Online Information and Database Access or Retrieval (OIDAR) service providers outside India for their services to unregistered persons in India | Monthly, 20th of the succeeding month |

| GSTR-6 | To be filed by Input Service Distributors for distribution of ITC | Monthly, 13th of the succeeding month |

| GSTR-7 | To declare TDS liability by the authorities deducting tax at source | Monthly, 10th of the succeeding month |

| GSTR-8 | To declare Tax Collected at Source (TCS) by e-commerce operators | Monthly, 10th of the succeeding month |

| GSTR-9 | To be filed by all the normal taxpayer declaring the details of purchase, sales, input tax credit, refund claimed, demand created, etc. | Annually, for a financial year is 31st of December of the year following the relevant financial year. |

| GSTR-9A | To be filed by GST composition scheme taxpayers declaring the details of outward supply, inward supply, taxes paid, refund claimed, demand created input tax credit and reverse due to opting out or opting in to the composition scheme. | Annually, for a financial year is 31st of December of the year following the relevant financial year. |

| GSTR-11 | To be filed by Unique Identity Number (UIN) holders stating the supplied/received goods and services. To claim GST refund through RFD-10 | Quarterly, not mandatory for UIN holders who did not receive any inward supplies during the quarter. 28th of the next month for which refund statement is filed . |

When should a business with turnover < 5CR file GST returns?

Return filing frequencies and dates are subject to revision. Please ensure that you know the latest filing frequencies for the returns applicable to you. The Quarterly Return Filing and Monthly Payment of Taxes (QRMP) Scheme was introduced on 1st January 2021, to help small taxpayers (turnover less than ₹5 Crore) to file GSTR-3B and GSTR-1 on a quarterly basis and pay tax every month. 22nd of month next to the quarter for taxpayers in category X states/UTs and 24th of month next to the quarter for taxpayers in category Y states/UTs

- X Category States - Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh or the Union territories of Daman and Diu and Dadra and Nagar Haveli, Puducherry, Andaman and Nicobar Islands and Lakshadweep.

- Y Category States - Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand, Odisha or the Union Territories of Jammu and Kashmir, Ladakh, Chandigarh and New Delhi.

Determine which returns are applicable to you and note them down in the order of their due dates. Ensure you record all the information required to be reported in these returns. When in doubt, reach out to a GST Suvidha Provider (GSP) or a GST Practitioner

Moreover, you can easily file your GST returns through the TCS iON GSP solution - a GST returns management portal, where the user can upload invoices and file their GST returns.

What’s next?

Now that you are familiar with the basics of GST and types of GST, the next step is to understand how you can streamline your ITC reconciliation in our upcoming topic.

To learn more and be a part of our growing community, Register on TCS iON BizHub today.