In this blog, we will introduce the concept of E-Invoicing, focusing on what E-Invoicing is, to which businesses it is applicable and mandatory to generate invoices. Additionally, we will explore the positive impacts of E-Invoicing such as enhancing efficiency and reducing errors. We aim to highlight how E-Invoicing not only modernizes financial processes but also contributes to cost saving.

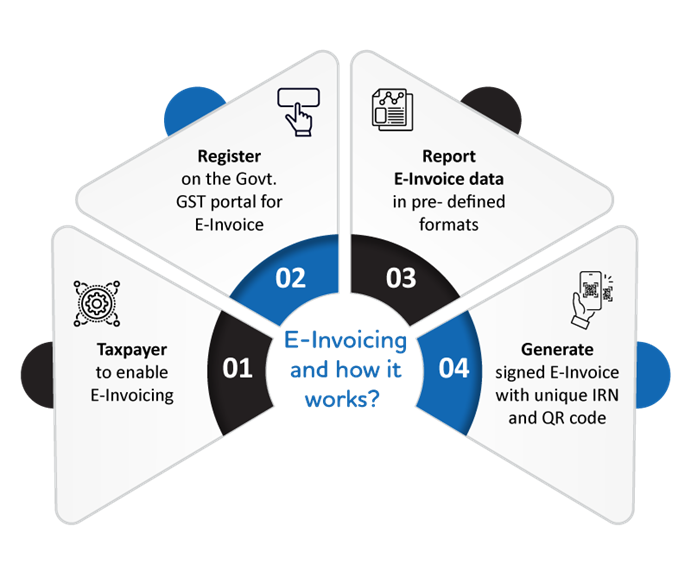

What is E-Invoicing and how it works?

E-Invoicing or electronic invoicing is a process wherein businesses register their invoices digitally adhering to a common format. Registered taxpayers will continue to create/generate/raise their GST invoices on their own Accounting/Billing/ERP Systems. Under the GST regime, generated invoices are required to be registered digitally through the Invoice Registration Portal (IRP), the central registry of the government for invoices. IRP then assigns a unique 64-digit number to each invoice called Invoice Reference Number (IRN) along with QR code to each successfully registered document. IRN is generated by converting characters into numbers. This number consists of following three parameters:

- Supplier GSTIN

- Supplier’s document number. For example, invoice number

- The financial year in ‘YYYY-YY’ format

Tax Invoices, Credit Notes & Debit Notes, when issued by notified class of taxpayers (to registered persons (B2B) or for the purpose of Exports) are currently covered under E-Invoice. Financial/commercial credit notes are not required to be reported to IRP for E-Invoicing purposes.

4 Steps for E-Invoice reporting

Applicability of E-Invoice

Below is the schedule highlighting date wise applicability of E-Invoicing to taxpayers having Average Annual Turnover (AATO) within given turnover range. This AATO condition needs to be checked for a given PAN from FY 2017-18 till current FY for deciding about E-Invoice applicability.

E-Invoice mandate starting dates for the AATO

| Average Annual Turnover (AATO) | E- Invoicing made mandatory from |

|---|---|

| Above Rs 500 Cr | 01-10-2020 |

| Rs 100 Cr to Rs 500 Cr | 01-01-2021 |

| Rs 50 Cr to Rs 100 Cr | 01-04-2021 |

| Rs 20 Cr to Rs 50 Cr | 01-04-2022 |

| Rs 10 Cr to Rs 20 Cr | 01-10-2022 |

| Rs 5 Cr to Rs 10 Cr | 01-08-2023 |

| Less than 5 Cr | OPTIONAL |

Exemptions in E-Invoice

E-Invoicing is not applicable / is exempt to following entities/sectors.

- Special Economic Zone Units (However, SEZ Developer category GSTINs are required to comply with E-Invoicing if applicable)

- Insurers

- Banking companies or financial institutions, including a non-banking financial company (NBFC) Goods Transport Agency (GTA) supplying services in relation to transportation of goods by road in a goods carriage

- Suppliers of passenger transportation service

- Suppliers of services by way of admission to exhibition of cinematograph films in multiplex screens

- Persons registered in terms of Rule 14 of CGST Rules (OIDAR)

Advantages of GST E-Invoicing system

E-Invoicing has many advantages for businesses such as

1. Auto-reporting of invoices into GST return i.e. GSTR-1/2A/2B,

2. Auto-generation of E-way bill (wherever required).

3. E-Invoicing also facilitates standardization and inter-operability leading to reduction of disputes among transacting parties, improves payment cycles, reduces processing costs and thereby greatly improving overall business efficiency.

4. Once an e-Invoice is generated, it can only be cancelled within 24 hours from date and time of its generation. It cannot be edited or amended as such. However, once this time limit of 24 hours is passed for cancellation, user can directly edit values of this invoice into GSTR-1 once it is auto populated on GSTN Portal from e-Invoice data.

In case you are using any accounting software to generate invoices, you will have to ensure that the software follows the unified format specified by the government to comply with the E-Invoicing system. There are many software products that can help you easily comply with e-Invoice system. One such product catering to the requirements of E-Invoicing for large enterprises and SME businesses in India isTCS iON E-Invoicing solution. This solution is 100% made in India, easy to use, 100% secure, can integrate with an ERP system, gives you multiple options for invoice generation while maintaining end to end E-Invoicing compliance.

What’s coming up next?

We will explain more about E-Invoicing by Busting Myths and Highlighting Benefits for modern Businesses in our upcoming articles.

To learn more and be a part of our growing community, Register on TCS iON BizHub today.