GSTR- 1A

GSTR - 1a is an important component of India’s GST compliance system, allowing businesses to reconcile their outward supplies reported in GSTR-1. It provides an opportunity to accept, modify or reject discrepancy before finalizing data in GSTR - 1. This process ensures accuracy and reduces the risk of mismatches in tax filings. In this blog, we will explore the purpose, process and key considerations for managing GSTR - 1A effectively to maintain compliance with and streamline your GST filings.

What is GSTR- 1A?

Before the implementation of GST, it was an issue for taxpayers to file taxes, compute their tax liabilities and stay compliant, but with the introduction of GST, the tax structure was simplified and return filing process was streamline, which resulted in smooth functioning of business. Now taxpayers have access to file returns in digital way. i.e., online.

Commercial transactions are now not a tedious task to note as the auto population of data made it easier for suppliers and receivers to furnish details. In this new GST regime apart from simplifying the entire tax filing process, it also reduces their errors and mistakes by allowing them to amend and modify the details so even the mismatch if there’s any.

All these changes were once possible by filing GSTR -1A, which later was discontinued. In this blog we will deep dive into the technicalities of GSTR-1A and try to understand how GSTR-1A allowed these taxpayers to rectify any mismatch of details and what the procedure involved.

Let’s learn about what is GSTR -1A and its purpose. In simple terms, it is where the registered taxpayers get to modify or update the details furnished in GSTR -1. It is a form introduced for allowing amendments in GSTR- 1 before filing the GSTR - 3B ; however, the form has no longer been in operation since 2017 and introduced again in July 2024.

What is the difference between GSTR- 1A and GSTR -1?

GSTR -1 is a statement in which a business needs to capture all the outward supplies made during the month or quarter, which means GSTR-1 is a return in which details of sales and outward supplies need to be captured. The Submission is on monthly and quarterly basis depending upon the specific category of the taxpayer. It includes all the transactions related to sales and supplies conducted by taxpayers within the specified tax period. Whereas GSTR-1A gets the details from the auto- drafted supplies and was meant for the purpose of submitting any amendments, modifications, additions or deletions to the records already submitted by the recipient in filed GSTR - 1 of that month.”

Who can file GSTR - 1A?

GSTR -1A can be filed by any registered taxpayer when there is any error after filing their GSTR-1. It is also useful for those who need to correct the records relating to the supply of goods or services or to add any new records that were missed while filing GSTR - 1.

GSTR -1A and its key takeaways

Firstly, there is no specific due date for filing GSTR -1A, should be filed before GSTR-3B for the same tax period.

1. GSTR- 1A has come into the picture to ensure proper tax record is provided, it is an optional facility given to the taxpayers.

2. There is no option to file a Nil return for GSTR-1A and if needed to file can be filed online.

3. If any changes need to be made should be of the current tax period any changes which are related to the previous tax period should be made by filling the subsequent GSTR - 1.

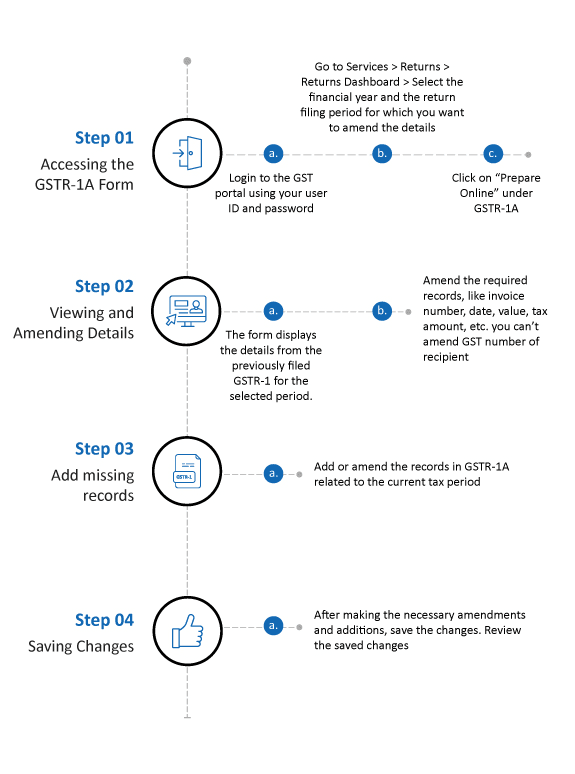

How to file GSTR-1A?

GSTR-1A due date

GSTR - 1A can be filled till the filling of GSTR -3B of the same tax period. Hence there is no set date for filling. To file GSTR - 1A is optional. Taxpayer can file GSTR - 1A if there is any new record which taxpayer missed out while filling GSTR-1 and to modify records which are already reported in the same period in GSTR - 1.

Conclusion

GST has brought many changes starting from introduction of GST, which is fruitful and easy for the taxpayers, being a new addition in the tax system, it was more confusing and difficult. Due to improvements in the system leading to simple and unified tax structure. To monitor the government has introduced this form-based reporting for registered taxpayers, which has simplified the entire process. It is an advantage for the government as well as the registered taxpayers. For the government it helps in calculation of tax liabilities and to taxpayers reducing the possibilities of any errors and mistakes on their part while filing their returns. Here by using the form GSTR-1A the taxpayers are provided with the scope of reducing the possibilities of any errors and mistakes on their part while filling their return. The re-introduction of GSTR - 1A will help automatically help data to be modified in GSTR 2A including GSTR -3B.

When in doubt, reach out to a GST Suvidha Provider (GSP) or a GST Practitioner. Moreover, you can easily file your GST returns through the TCS iON GSP solution - a GST returns management portal, where the user can upload invoices and file their GST returns.

To learn more and be a part of our growing community,Register on TCS iON BizHub today.