In this blog, we will discuss about what is GSTR 1? Due date for the same to avoid the late fees penalty, how to file GSTR 1 and how can you revise the GSTR1 if it needs to be amended.

What is GSTR 1?

Under the GST system, every registered taxpayer has to file the details of outward supplies (sales) made during that specific period (month or quarter) in the GSTN portal. These details are required to be filled in a statement referred to as Form GSTR 1, which is filed on a monthly or quarterly basis, by all registered persons under GST, except for the following :

- Input service distributors.

- Dealers under the composition scheme of GST.

- Suppliers of online information and database access or retrieval services who have to pay tax themselves.

- Non-resident taxable persons.

- Taxpayers liable to collect tax at source (TCS).

- Taxpayers liable to deduct tax at source (TDS).

GSTR 1 due date

The due dates of GSTR 1 along with frequency are mentioned in the below table. To know more about GSTR filing you can look for the same in the past blog published Types of GST Returns: What, When, and How often to file.

The due date for filing GSTR-1 is determined by your turnover, or by your participation in the ‘Quarterly Return Filing and Monthly Payment of Taxes Scheme’ (QRMP Scheme). The QRMP Scheme can be availed by small taxpayers with turnovers up to ₹5 Crore to file GSTR-1 and GSTR-3B on a quarterly basis and pay GST on a monthly basis.

If your business has a turnover of up to ₹5 Crore, you have the option to file GSTR-1 quarterly under the QRMP Scheme - these are due by 13th of the month following the quarter. If your turnover exceeds ₹5 Crore, or you have not otherwise opted for the QRMP Scheme, you need to file your GSTR-1 monthly by the 11th of next month.

| Type | Purpose | Frequency and Due Date |

|---|---|---|

| GSTR –1 | To be filed by all the normal taxpayers stating their outward supplies of goods and services during the applicable tax period. | Turnover < Rs. 1.5 crore – Quarterly, 31st of the month succeeding the quarter Turnover > Rs. 1.5 crore – Monthly, 11th of the succeeding month. |

How to file GSTR 1

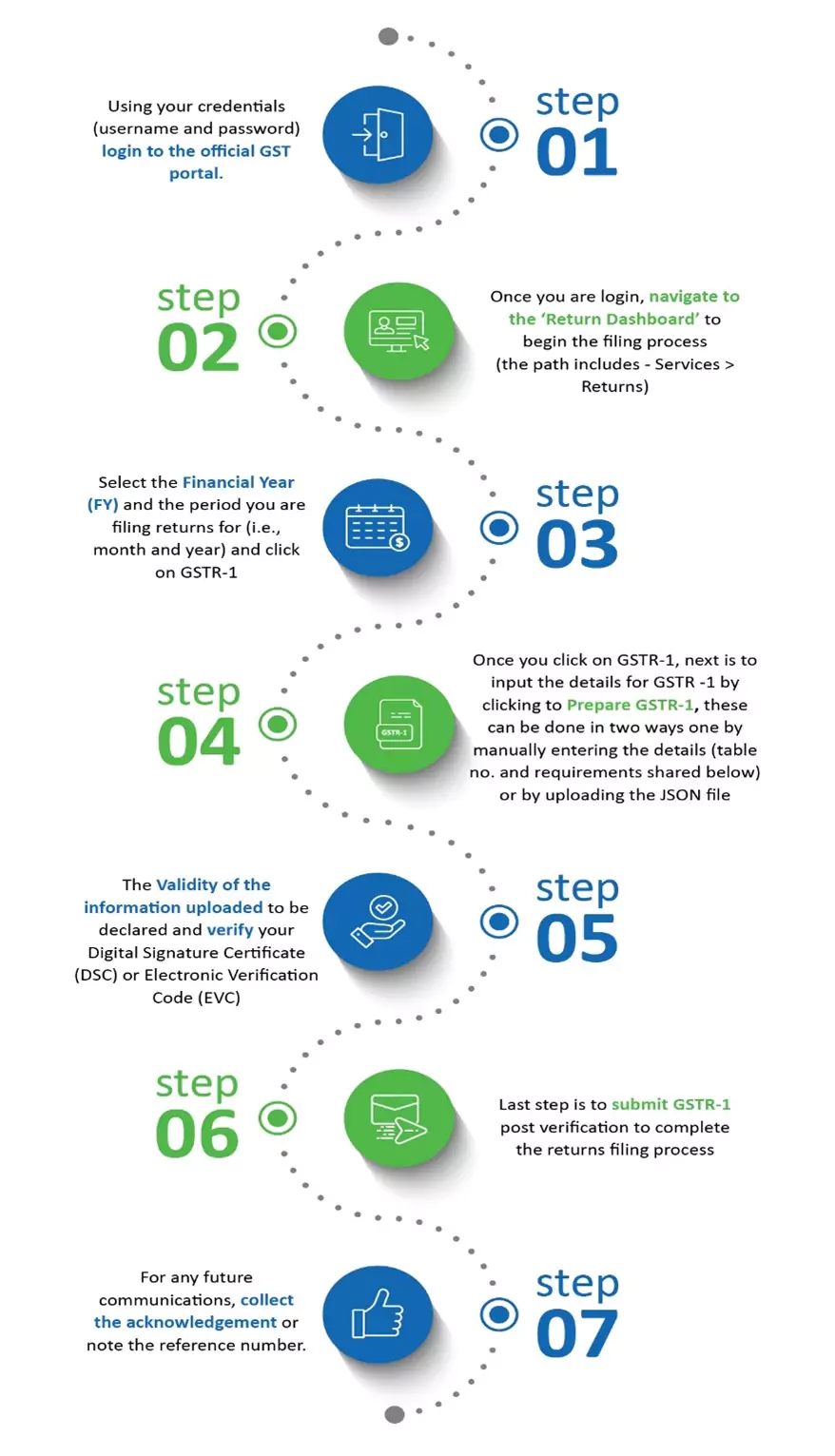

After learning about GSTR 1, eligibility and due date, let’s understand step by step how to file GSTR 1 online.

- Login to the official GST portal using your credentials (Username and password).

- Navigate to the ‘Return Dashboard’ to begin the filing process (Follow the path: Services > Returns).

- Select the Financial Year (FY) and the period you are filing returns for (i.e., month and year) and click on GSTR-1.

- Prepare GSTR-1 (You can manually enter details by clicking on Prepare Online and filling in the details; or can upload a JSON file by preparing the GSTR-1 using offline tools)

- Declare the validity of the information uploaded and verify using your DSC (Digital Signature Certificate) or EVC (Electronic Verification Code).

- Submit GSTR-1 post verification to complete the returns filing process.

- Collect the acknowledgement or reference number for any future communications.

Below details are the one which will be handy for you to easily complete the step 4 i.e. inputs (as applicable) to file GSTR 1:

| Table No. | Particulars |

|---|---|

| 1 ,2,3 | GSTIN, legal and trade name and aggregated turnover of previous year |

| 4 | Details of taxable outward supplies to registered persons (including UIN holders) excluding zero-rated supplies (supplies exempted from GST) and deemed exports (supplies of goods manufactured in India which do not leave India but are notified as deemed exports) |

| 5 | Details of taxable outward inter-state supplies to unregistered persons where the invoice value exceeds ₹2.5 Lakh |

| 6 | Details of zero-rated supplies as well as deemed exports |

| 7 | Details of taxable supplies to unregistered persons other than the supplies covered in Table 5 (net of debit notes and credit notes) |

| 8 | Details of outward supplies that are nil rated, exempted and non-GST in nature |

| 9 | Amendments to outward supplies that are taxable and reported in tables 4, 5 and 6 of GSTR-1 of earlier tax periods (including debit notes, credit notes, refund vouchers issued during the current period) |

| 10 | Debit and credit notes issued to unregistered persons |

| 11 | Details of advances received or adjusted in the current tax period, or amendments of the information reported in an earlier tax period |

| 12 | HSN - wise summary of outward supplies |

| 13 | Serial numbers and series of documents issued and cancelled |

| 14 | For suppliers - Reporting ECO operators' GSTIN-wise sales through e-commerce operators on which e-commerce operators are liable to collect TCS u/s 52 or liable to pay tax u/s 9(5) of the CGST Act |

| 14 A | For suppliers - Amendments to Table 14 |

| 15 | For e-commerce operators - Reporting both B2B and B2C, suppliers' GSTIN-wise sales through e-commerce operators on which e-commerce operator must deposit TCS u/s 9(5) of the CGST Act |

| 15 A |

|

If you are following the e-Invoicing process under GST, the details of such e-Invoices will be auto-populated in the respective tables of GSTR-1. These details can be downloaded as an Excel file. It is recommended to download the e-Invoice details and review them to ensure your GSTR-1 is not missing any data.

How to revise GSTR 1?

A GSTR-1 needs to be filed irrespective of whether you have any transactions in the reporting period. If you have a ‘Nil’ return, you can opt to file your GSTR-1 using the SMS facility that was made available last year. Once GSTR-1 is filed, it cannot be revised.

Any taxpayers who want to amend any invoices filed in GSTR-1 or add any invoices for same tax period can file GSTR-1A in the same month. GSTR-1A can be filed post filing of GSTR-1 and before filing GSTR-3B for the same tax period. Want to know about GSTR 1A? We will have a detailed study in the upcoming article.

If you have opted for QRMP Scheme, you can provide the invoice details for the first two months of a quarter through an online Invoice Filing Facility (IFF) available on the GST portal. You can provide any remaining invoice details in the quarterly GSTR-1. If you need to rectify any mistake in a GSTR-1 that has already been filed, you can only do so in the next period’s GSTR-1.

GSTR 1 Late fees and Penalty

Non-filing of GSTR-1 attracts a late fee.

For nil return

Currently, you will be charged ₹20 per day for delayed filing of returns and maximum fee is upto ₹500 per day for nil return.

For other than nil return

- Late fees for every day of delay is ₹50.

- Maximum late fee if the annual turnover in the previous financial year is up to Rs.1.5 crore is ₹2000.

- Maximum late fee if the annual turnover ranges between Rs.1.5 crore and Rs.5 crore is ₹5000.

- Maximum late fee if the turnover is more than Rs.5 crore is ₹10000.

You can easily file your GST returns through TCS iON GST Compliance Solution a GST returns management portal, where the user can upload invoices and file their GST returns. See if you are eligible for the QRMP Scheme. Review your accounting/invoicing records to ensure you have all the information required to file your GSTR-1 return completely and accurately.

To learn more and be a part of our growing community, register on TCS iON BizHub today.